Content

Limitations are typical constraints you to are different notably by the financial and membership kind of. Such limits are typically less than what you are able put inside individual or from the ATMs. Such as, of numerous banking companies lay each day cellular deposit restrictions anywhere between $2,000 and you may $5,100, however some render high constraints to have centered users. Cellular deposits are believed while the safe and sound while the any bank-approved form of deposit a. The brand new Chase Mobile application, such as, never ever places passwords or visualize research on the device while using the Pursue QuickDeposit℠. Simultaneously, mobile deposits so you can FDIC-covered account try protected the same as any deposit.

This action eliminates the need to in person check out a financial department otherwise Automatic teller machine, preserving time and offering independence. Most banks and you can borrowing unions provide cellular consider deposit at no cost, however some may charge charges definitely membership versions or a lot of deposits. Review your lender’s commission agenda to verify whether mobile places is actually 100 percent free to possess your bank account.

- Compensation could possibly get influence exactly how and you may where points are available, along with its purchase within the listing groups.

- It conserves go out, features your finances moving shorter, and provide your more independence in how your lender.

- Put checks1 when you discovered him or her – skipping the newest stop by at the newest branch otherwise Atm.

- Mobile consider places offer a convenient means to fix deal with your own financial, but both places will likely be defer or rejected due to common problems.

- Depositing a newspaper take a look at through cellular deposit is just as secure and you may secure as the taking the money to help you a branch.

You can check the financial institution’s web site to have typical deposit time so you understand what in order to anticipate. Whether it seems like they’s delivering such a long time, label the bank’s customer service matter to ask. Availability hinges on the new membership your’lso are depositing to your and the deposit method.

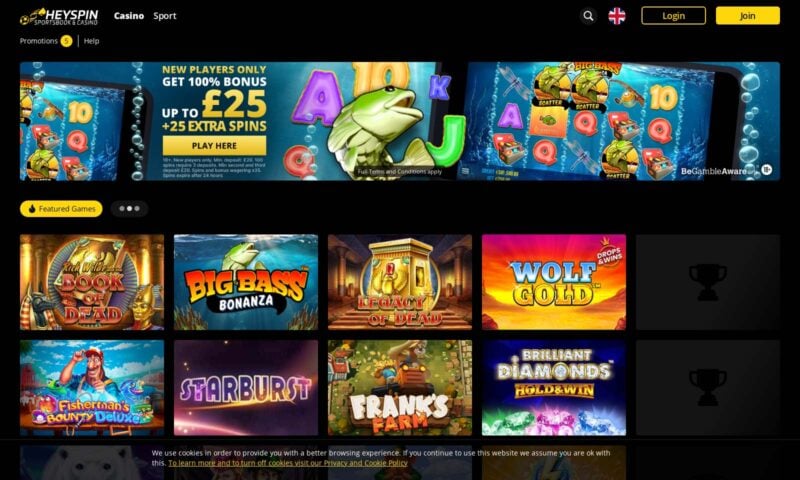

So you will be encouraged to mobile Royal Panda casino choose some other preferred payment strategy after you consult a withdrawal. This is crucial so that your picked gambling enterprise could possibly statement you and to confirm your own identity. You’ll be asked to pursue certain particular prompts to do the exchange, ahead of guaranteeing it. Choose one of your own casinos in the above list and you will after you is happy with the brand new gambling establishment have, subscribe and you may browse to their percentage webpage. You’re at the mercy of both everyday and month-to-month restrictions to make use of the service.

Mobile deposit: mobile Royal Panda casino

All-content on this web site is for informative intentions merely and cannot make-up economic information. Consult associated monetary benefits in your nation out of home discover individualized advice prior to one change otherwise spending behavior. DayTrading.com will get found payment in the names or services mentioned to the this amazing site. The purchase price hinges on the new seller – some, such as Fruit Shell out, don’t costs profiles any additional charge, rather delivering a tiny cut of one’s purchase in the financial.

Ways to Stay safe When using Cellular Banking Applications

Very monitors deposited individually from the teller screen are available in your checking or savings account immediately. Players you may now put fund to the an on-line casino which have a few taps of the smartphone screen. The method and advice is actually encoded after you deposit a on the a mobile financial software. That means that the images of the view commonly stored in your town on your cellular telephone anywhere for it to be stolen or on how to eventually send they for the completely wrong people.

What is actually mobile view deposit?

Secure approximately 10x the new national average interest which have an excellent SoFi high-give bank account. There is nothing illegal regarding the transferring less than $ten,000cash until it is over particularly to help you evade the new revealing requirements. There’s no dollars restrict to your number in which you is also put through a from the an atm, and you can find an automatic teller machine towards you by using our Locator device. Always indication the rear of the consider and include instructions such since the “For Mobile Put Only.” This helps stop unauthorized deposits. If your app implies that the images of one’s view is actually not sure or blurry, is retaking the new pictures within the better lights. Immediately after properly capturing of your view, might usually need to enter the quantity of the new view.

She’s already been talking about personal money because the 2014, and her works features starred in numerous guides on the internet. Beyond banking, the woman options covers credit and you can debt, college loans, investing, home buying, insurance coverage and you will business. If you would like follow similar fee procedures using only their mobile, you can attempt Siru Mobile, PayForIt otherwise Boku. But there are many almost every other ways to is actually for example e-wallets, such.

Connecting in initial deposit account is how the fresh credit card providers make certain that you to any finance you put are FDIC-insured. Lender away from The united states has a practically limitless every day cellular put limit for your account manager. Banking software will demand you to definitely publish an image of your back and front of your own seek out opinion. You’ll have to indication the back of the brand new take a look at before you could snap a photo to do the brand new mobile put. With your fundamental finance availability, places finished just before 10 p.yards. ET for the a corporate date will be offered the following day at the no charge3.

Some loan providers get an automobile-get function that will instantly snap a photograph to you personally when the your hover the phone’s camera over the consider. Specific financial institutions tend to ask you to produce particular text message for the the rear of the new consider, otherwise take a look at a package, authorizing it for secluded put just. Alternatively, particular financial institutions make basic $225 of the put available on the same date and/or next working day, and therefore the others available the following working day.

.png)

For many who’lso are being unsure of, visit your bank’s website otherwise label customer care. As well, ensure that your account is in an excellent position, while the specific banking companies could have certain criteria otherwise limits for cellular deposits. Perhaps first of all, mobile consider places is actually because the safer because the any on line financial solution. While you’re using the bank’s legitimate cellular application, the information you publish is protected by security, and look pictures are not stored on the equipment. Mobile put is when you deposit a check using your mobile equipment (a telephone or tablet). A lot of banking companies enable you to put monitors this way thanks to the cellular software.

If you see how fast and simple it’s, you will never come back to position in line from the bank. The lender most likely provides a daily, each week, or month-to-month restrict for the consider amounts you can deposit due to their app. Including, that have Navy Federal Credit Union (NFCU), you might put up to 10 inspections each day, to all in all, $50,100 daily. Financial, deposits is restricted to $50 on the certain account one refuge’t started open for at least 90 days. You can put checks payable inside You.S. dollars and you may pulled any kind of time U.S.-dependent bank, along with personal, company, and most authorities inspections. Bankrate.com try an independent, advertising-served blogger and you may assessment service.

You might deposit as many monitors as you would like because the long since you don’t exceed the fresh each day and over 29-date months limitations. Fundamentally, you can access monitors to own $two hundred or quicker the following working day. To have inspections more $200, you can essentially availability $200 next working day, and the remainder of your view matter next working day. Wells Fargo tend to keep particular otherwise all of the fund when the the fresh placed view can also be’t getting canned right away.